The Safest Way to Earn Interests With Dai

- 投稿び

The DSR in a Nutshell#

Multi-Collateral Dai(MCD) went live on November 18th. Now you can use both Eth and Bat as collateral. The Maker community is currently evaluating REP, and other tokens will be available as collateral in the future.

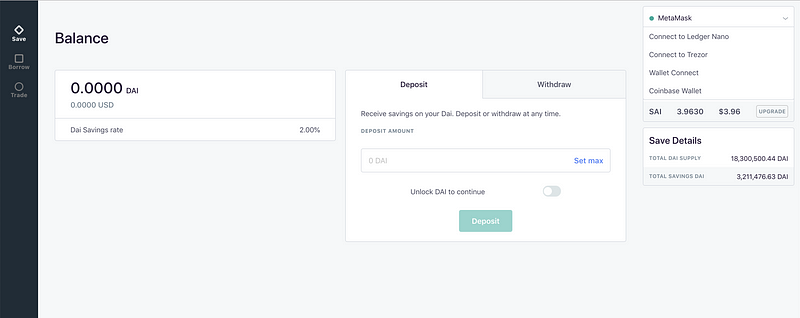

Another big change in MCD is the Dai Savings Rate(DSR). It is a permissionless version of a savings account in a bank except all the money is always available unlike a fractional reserve system of a bank. Anyone can gain interests with no fees by depositing their Dai into the DSR contract because there are no gatekeepers or a minimum deposit required. Furthermore, you can withdraw all of/part of your deposit at any time along with the savings earned up to that point.

You can already start saving through Oasis Save.

Dai continuously accrues based on the rate once you lock it into the DSR contract. If you lock 1000 Dai into the DSR contract and keep it locked for a full year, you would earn 20 additional Dai. When you unlock your Dai in the contract after a year, 20 Dai will be added to your account(I’m assuming that the rate stays the same for simplicity).

The initial value was set to 2% through the governance poll. The MakerDAO governance will keep adjusting the value like the stability fee. There will be no retroactive changes. But if a change is made in the DSR, your deposit is affected.

The DSR Helps Maintaining Dai’s Stable Value#

The DSR works as another stability force on top of the existing mechanism. First, the demand side of Dai, which affects Dai holders. Second, the supply side of Dai, which potentially affects vault users.

The Demand Side#

If the market price of Dai is below 1 USD, the DSR may be raised. This should boost demand. A high savings rate gives people a reason to acquire more Dai and hold on to it, which increases the market price up towards the 1 USD target price. Conversely, if the market price of Dai is above 1 USD, the DSR may be lowered. This should stifle demand. A low savings rate gives people a reason to sell Dai and not to hold on to it, which reduces the market price of Dai down towards the 1 USD target price.

The Supply Side#

The supply side of the theory is based on the assumption that there is a correlation between the DSR and the stability fee. This is especially true when the DSR increases. If the total amount of stability fees collected in Dai does not cover the total amount of Dai for the DSR, and MKR is minted to cover the cost. Since MKR holders don’t like their token to depreciate, they are incentivized to increase the stability fee and make sure that there is enough to cover the interest in the DSR. Conversely, when the DSR decreases, the governance might decide to lower the stability fee.

If the assumption were true, the change in DSR would influence vault users and impact the supply side of Dai.

If the market price of Dai is below 1 USD, the DSR may be raised. This should stifle supply. It discourages vault users to generate Dai because the stability fee might increase as well, which increases the market price up towards the 1 USD target price. Conversely, if the market price of Dai is above 1 USD, the DSR may be lowered. This should boost supply. It encourages vault users to generate Dai because the stability fee might decrease, which reduces the market price of Dai down towards the 1 USD target price.

Although we still don’t know how this will turn out, we can say that the Maker governance is going to face another challenge as the DSR will add more complexity to the process.