What is DAICO?

- Published time

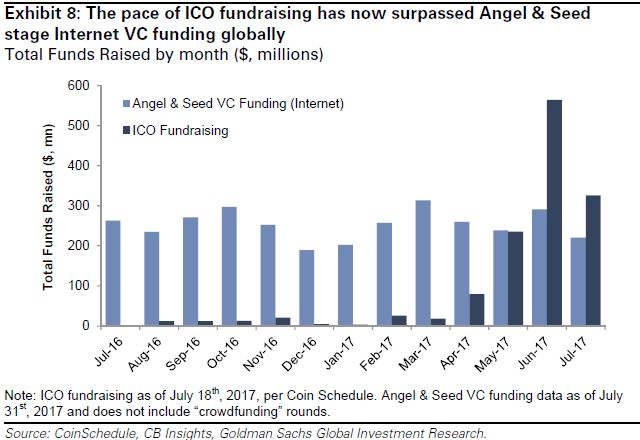

Since the first ICO of Ethereum on Sep 2, 2014, ICOs have been killing it as a new, democratic and open way to raise funds. For example, early this year, LoopX(a peer to peer trading platform) raised approximately 4.5 million dollars. If you were in a world of a crypto, this might not sound impressive. But this is still significant considering our traditional fund raising schemes. ICO fundraising surpassed angel & seed stage Internet VC funding globally as of July 18th, 2017 already.

Furthermore, if you see the list of highest funded crowdfunding projects, there are already twenty three blockchain-based projects in Top 30 as of June 14, 2018. This is, despite the fact that ICOs have been around only for four years, whereas a traditional crowdfunding model such as Kickstarter has been around for almost ten years.

What is remarkable about the ICOs is that it will make a startup fund-raising more decentralized and democratic; instead of being dominated by rich people in VCs or angels, anyone can participate in the open market where the risks and the gains are more evenly distributed.

However, unfortunately, we have seen bad news about ICOs. The project that I mentioned previously, LoopX, shut down their websites immediately after the ICO, and presumably 4.5 million dollars was stolen from investors. It’s not difficult to find other scams like this in the market. Moreover, there are fake pledges. This is also the case in traditional crowdfunding, but fake pledges in ICOs are more problematic because the funds tend to be bigger.

Given this situation, ICOs seem to be too risky for investors. How can we protect their rights? Most of the governments are still not clear about this, but some governments have taken actions. South Korea banned all new ICOs following the example of China and SEC doesn’t seem to be happy about this. Although I don’t disagree that the intervention of the government to the market is necessary in some cases, the self-regulation in the market can work much more flexible and quicker.

So here comes DAICO. The DAICO model is the new ICO model that Ethereum founder @VitalikButerin proposed in this January. It is a self-regulatory framework to support ICOs while 1) mitigating the risk of investors and 2) preserving token issuer’s freedom to raise funds.

There are two important concepts in DAICO. The first is a tap. In the DAICO model, token issuers decide how much wei they can withdraw per a second(tap) upfront from the locked funds raised. They initiate their ICO in whatever forms they want: a capped sale, an uncapped sale, or a dutch auction. A staggered release of the fund prohibit token issuers from running away with their funds. The second is voting. Token holders have two voting rights after the ICO: 1) self-destruction of the smart contract(refund) and 2) the tap raising. If the proposal garners support from a majority, the contract will self-destruct or the tap is raised. The self-destruction of the contract will refund all the money left in the pool to investors. If the tap were raised, token issuers can withdraw more ETH per a second, which is a strong incentive for them to hustle. That’s it! The beauty of the DAICO model is its simplicity.

While this concept solves some of the problems and is a step forward towards a more reasonable ICO market, there are still some challenges to be handled. And we will cover them in the upcoming posts.